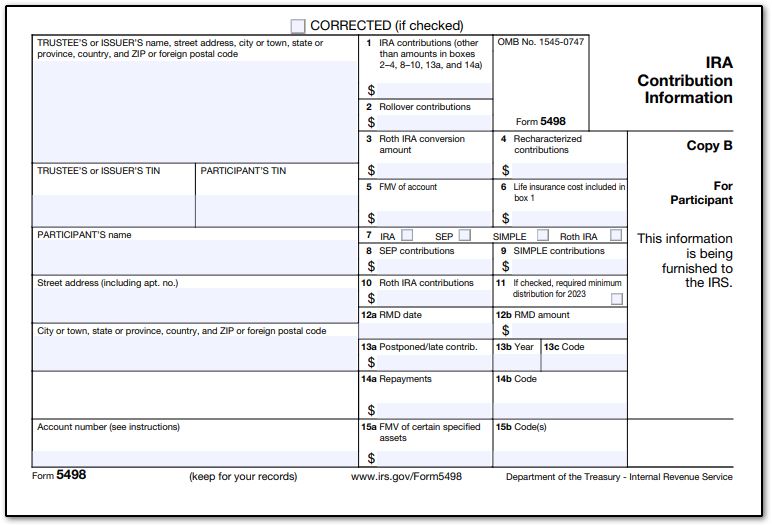

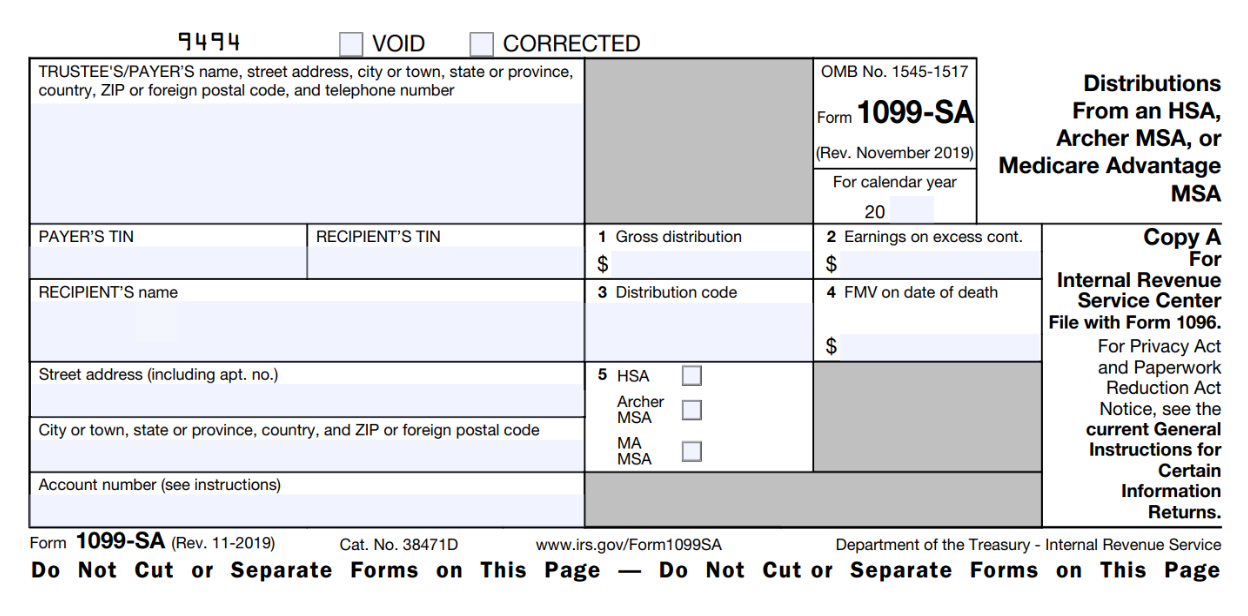

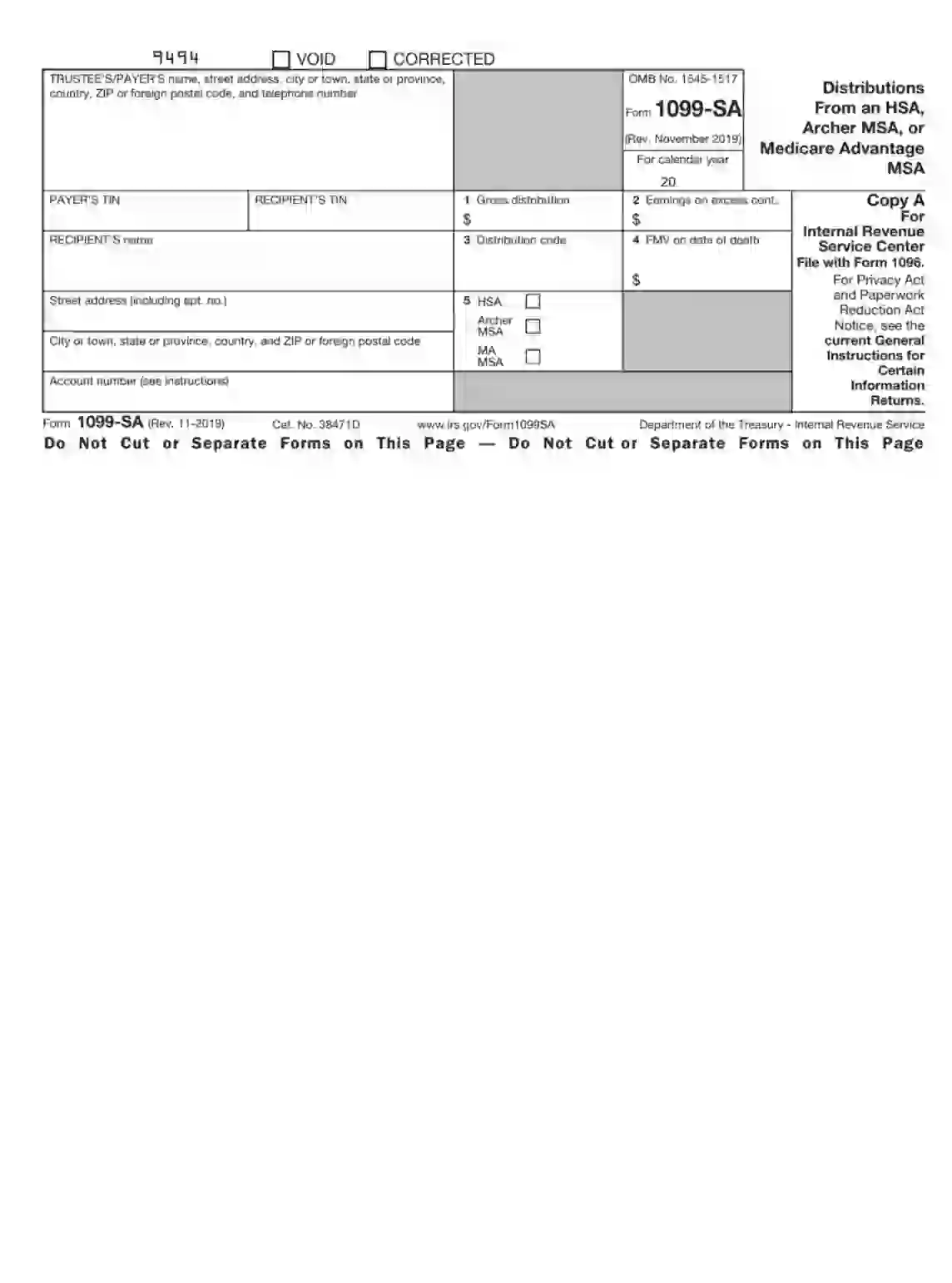

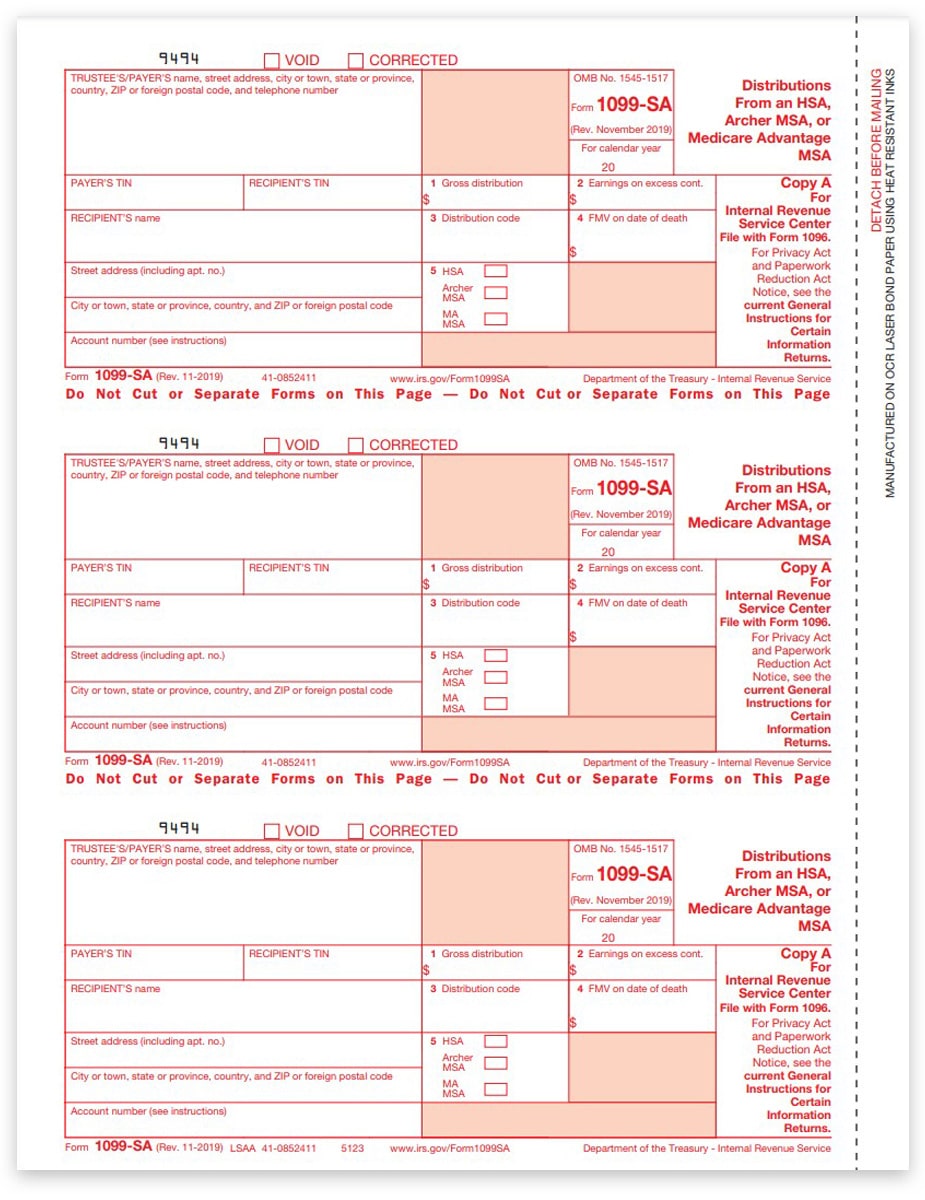

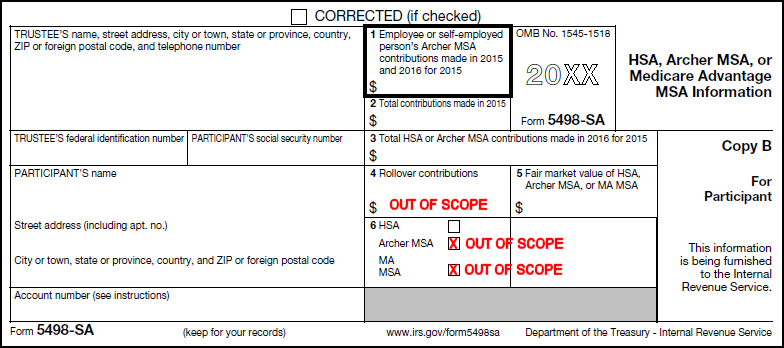

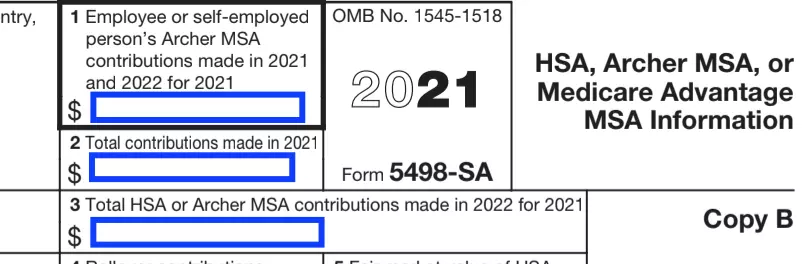

BMSAFED05 - Form 1099-SA Distributions from an HSA, Archer MSA, Or Medicare Advantage MSA - Copy A Federal - BrokerForms.com

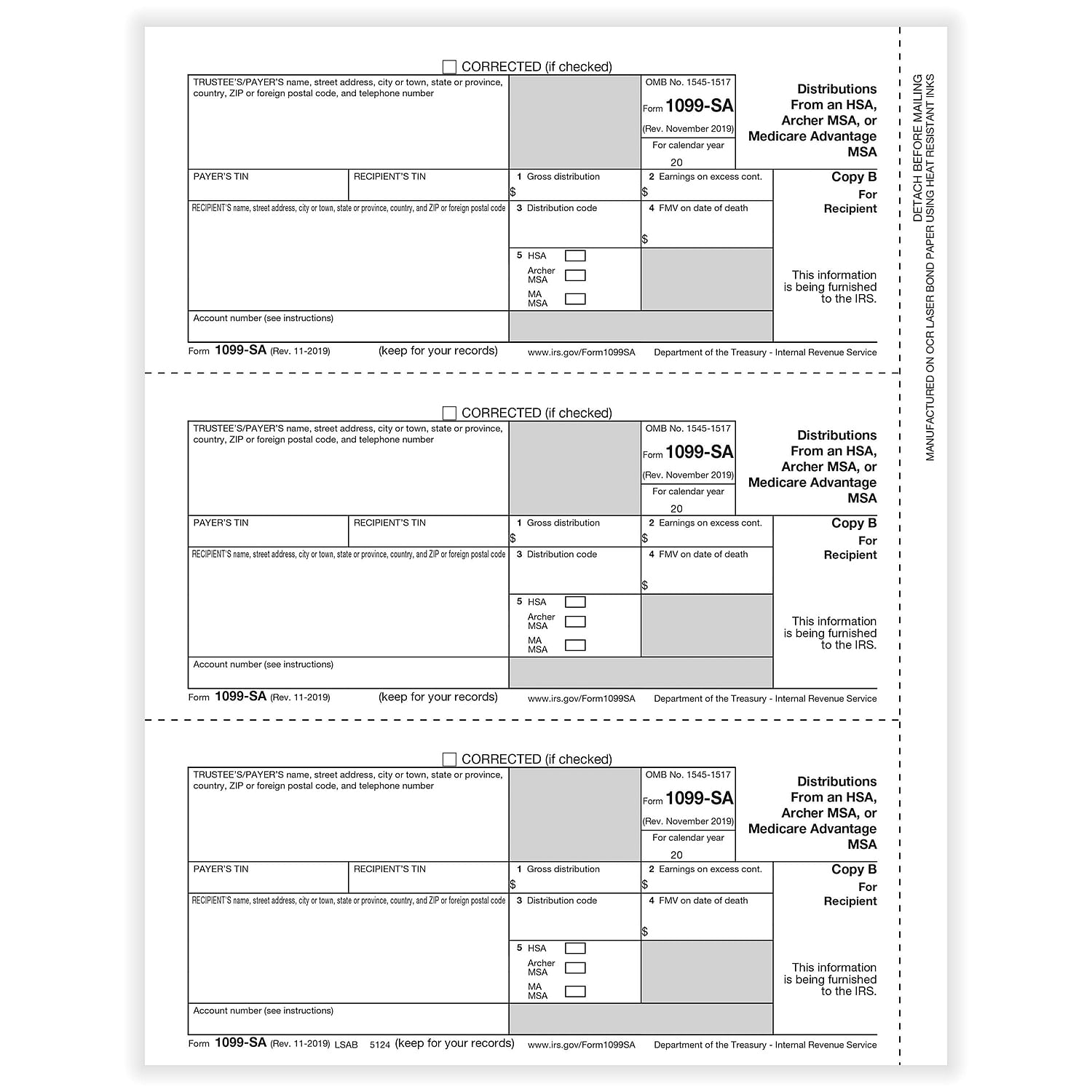

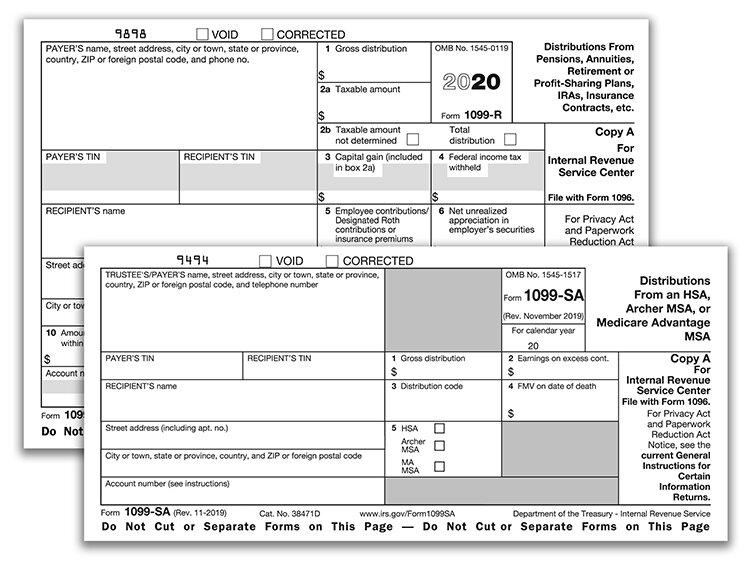

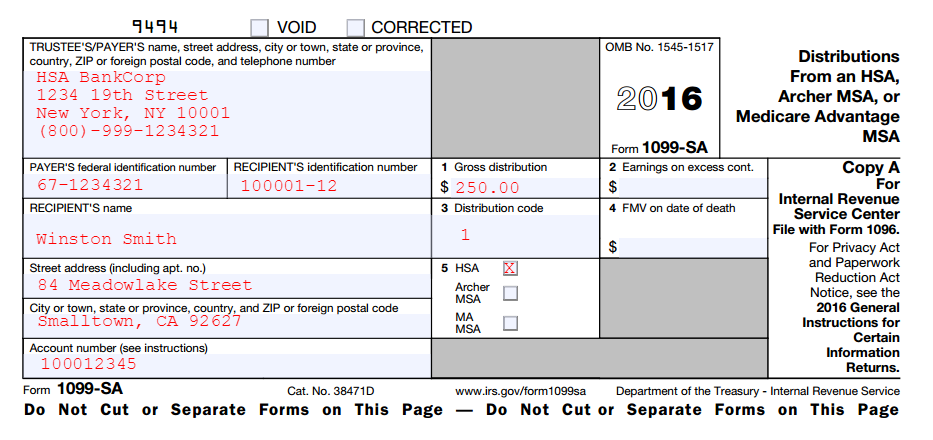

1099-SA Distribution From a HSA, Archer MSA or Medicare Advantage MSA Rec Copy B Cut Sheet (100 Sheets/Pack)

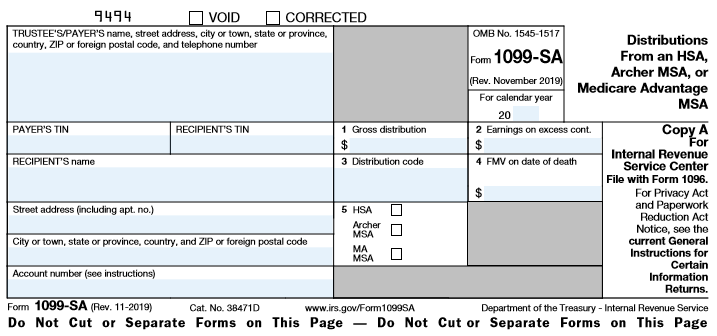

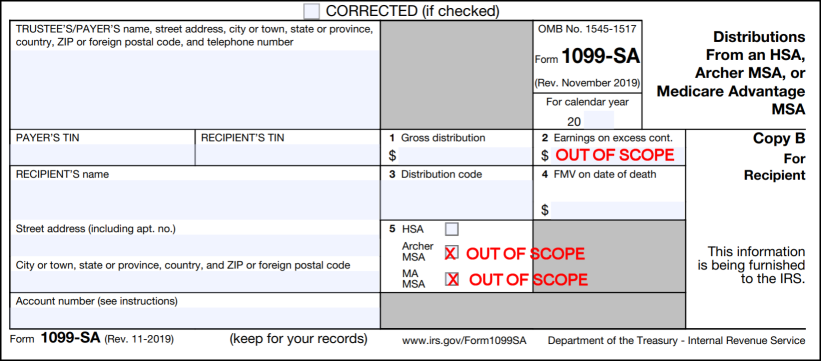

My 1099-SA box 3 has code 1. The correct option is 2, yes? 1. Withdrawal $2768. 2. Withdrawal the excess by April 15, 2021. 3. No, I'm not going to make a withdrawl.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)